There are many ways that QFD, the core of the new ISO 16355 standard, can help improve healthcare providers. Recent QFD Symposia have presented papers on improvements in clinical care, hospital design and infectious disease control, medical devices and equipment, and even health insurance programs.

These applications are somewhat universal no matter where you live. This newsletter will focus on how customers can apply QFD to select the best product for them — the point of view of the healthcare recipient. (The QFD and ISO applications discussed here can be utilized not just in healthcare but also in any industries from software to manufacturing, IT service, government and more.)

Medicare is a uniquely American health insurance for people who are 65 years and older. It is a governmental program that has been undergoing dramatic changes since its creation. Despite the good intention of the US lawmakers, Medicare requires of most senior citizens a highly confusing and complex decision making year after year. For those who are not familiar with this senior healthcare program, including the readers from overseas, let us explain:

The discussion for healthcare for all Americans began in 1912 during the election of President Theodore Roosevelt (Republican), but it did not gain broad exposure until 1945, when President Harry Truman (Democrat) envisioned a program to cover doctors, hospitals, lab tests, and other expenses; it was not passed into law.

In 1961, President Eisenhower (R) proposed a healthcare program for seniors during the first White House Council on Aging; it was not passed into law. President John F. Kennedy (D) furthered the idea of coverage for senior citizens, and in 1965, the US Congress enacted and President Lyndon B. Johnson (D) signed Title XVIII of the Social Security Act to provide health insurance to people age 65 and older.

Original Medicare, had two parts: Part A for hospital expenses and Part B for doctor expenses.

Part C that allows private insurers to offer risk-based policy choices was legislated in 1982 during the presidency of Ronald Reagan (R), and formalized by President Bill Clinton (D) in 1997. Part D, covering pharmaceuticals and drugs was proposed in 2003 under President George W. Bush (R) and took effect in 2006. In addition, a Medicare Supplemental Insurance Policy called 'Medigap' was formalized in 1990 by President George H.W. Bush.

Medicare is funded by a mandatory payroll deduction plus a matching employer contribution totaling 2.9% of the first $127,200 of your wages (in 2017). Senior citizens who choose to work beyond age 65 will continue to pay into the system. That means that most working Americans will have been paying for Medicare insurance for nearly 45 years even before she/he becomes eligible to use it.

Medicare requires you to make the following decisions as you approach your 65th birthday.

Stay on your company-provided health insurance plan (if currently employed and such a plan is available) OR change to government-provided Medicare.

If you choose Medicare, select government-sponsored Original Medicare Parts A, B, and D, OR select Part C, now called Medicare Advantage.

If you choose Original Medicare:

Part A is no additional cost (actually, this is what you have been paying for 45 years). However, Part A generally has an out-of-pocket deductible of $1,316/year (as of 2017). Hospital stays are covered for the first 60 days, and then you pay the first $329/day out-of-pocket for 61-90 days. After 150 days, you pay 100% of the hospital costs unless you buy Medigap insurance to cover these gaps.

Part B is offered for an additional monthly premium of $134 (in 2017). Generally, Part B has an out-of-pocket deductible of $183/year and 20% co-insurance, meaning that you will pay 20% of the doctor's cost. There is no limit on out-of-pocket spending unless you buy Medigap insurance.

Medigap insurance is optional. There are 10 or 11 plan options that offer different deductibles, medical services and levels of gap coverage. Since Medicap plans are administered by private insurance companies, the benefits differ, depending on the company and plan you select, as well as your age and where you live.

Part D (coverage for medication and drugs) is also optional and offered by some 30 private insurance companies, each with plans offering varying premiums, drug coverage, and co-pays. The monthly insurance premium for Part D depends on which medication you take, how often, in what dosage, and where you live. The same medication that might be no cost under one company might cost you over $100/month under another company's plan or if you live in a different region. You must research on your own every year to see if your Part D plan is still the best for you.

That's not all. It gets more complicated! Part D will cover a portion of the drugs up to a certain amount, then cover nothing, and then cover everything if the cost exceeds a certain catastrophic level. This portion in the middle that is not covered, is called interestingly, a "donut hole." The current Affordable Care Act is set to shrink this donut hole over the next few years, but that benefit may disappear if the ACA is repealed.

If you choose Part C or Medicare Advantage insurance, you are faced with a different set of choices. Medicare Advantage works like most private health insurance policies in America. This creates several choices regarding type and tier of coverage. Medicare Advantage plans replace parts A, B, and D.

First, you must choose if you want an HMO (health maintenance organization) which offers a preset selection of doctors and hospitals (except in emergencies) or a PPO (preferred provider organization) which offers lower costs for "in network" doctors and hospitals but higher costs for "out of network" providers.

Second, you must choose if you want Bronze, Silver, Gold, or Platinum tiers of coverage. These are based on how much annual deductible you must pay out-of-pocket before the insurance begins. For example, Bronze offers low monthly premiums in exchange for high deductibles, co-insurance, and co-pays, while Platinum is reverse.

Third, you must choose what insurance company to buy the policy from. These vary by state and even county where you live.

Given all these complicated options, how does a senior citizen decide? And, because plans change every year, this decision has to be reviewed every year for the rest of your life. We all know, as one gets older, the choices will get more difficult to understand.

One way to improve consistency is to have a model that a senior citizen can use to structure what is most important to him/her, what characteristics of the insurance plans relate to that, and then which plan offers the most important characteristics at the best price. Then, as his/her needs change in priority, the model can easily be updated each year to keep or change plans.

Structuring sounds like a job for QFD (Quality Function Deployment). But can the new ISO 16355 will help people choose which plan is best? The answer is Yes.

Here is how:

The first problem we QFD veterans notice is that all of the Medicare plan descriptions give functional requirements and solutions. They describe in detail "what" is covered and to a lesser degree "how" the plan will work. What is missing is the "why" should a person care about a particular plan or set of choices.

This is the same problem we face in new product / service / software development. That is, customers tell us what they want the product to be or do, but not why they want that feature. To paraphrase the late Steve Jobs of Apple Computer,

"It sounds logical to ask customers what they want and then give it to them. But they rarely wind up getting what they want that way." [Inc. Magazine 1989]

For example, Medicare covers second and third opinions for non-emergency surgeries, after you pay the deductible and 20% co-pay. Great - but why would you want that? What benefit do you get if you pay for this coverage? What benefit do you give up if you do not pay for this coverage?

We actually talked with four Medicare counselors (volunteer experts) to find out more. Without a pause, they all replied "it depends on what you are comfortable with." In other words, you are left to make assumptions about your comfort level with the literally hundreds of choices and unforeseeable future health issues, such as:

How sick am I now?

How sick do I think I might be in the future?

When will I be sick?

How much I can afford to pay in premiums each month?

How much can I afford to pay out-of-pocket if I get really sick, etc?

And repeat this year after year as you get older!

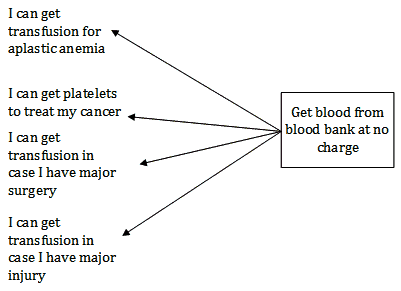

How can QFD and ISO help healthcare customers in this and similar complicated systems? In ISO 16355-4:2017 Clause 10, the process of translating product features into true, product-independent customer needs is described. It uses "wishbone" diagrams that many readers already know.

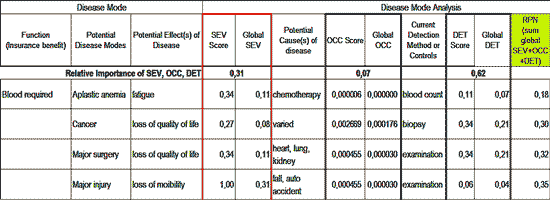

The second problem is that you have to determine how to balance the monthly premiums, out-of-pocket costs of co-insurance and co-pays, and the catastrophic costs of a very serious illness.

Impact of illness on my family and myself.

Likelihood of an illness.

Early detectability of an illness when it is easier to treat.

This sounds like an FMEA (failure mode and effects analysis), which is a commonly used engineering tool. Be sure to use the mathematically corrected version of FMEA covered in ISO 16355-5:2017 Clause 10.4.5.8, or your results may be skewed.

Just to add more complication to your decision making, there is one more regulation that stipulates, when you first enroll in Medicare at age 65, insurance companies cannot "underwrite" you (meaning, regardless of your current health, you cannot be rejected or charged more). After age 66, however, any changes you make can be underwritten (rejection, much higher premiums).

The third problem is how to select one plan from the many alternatives, and to be able to revise this each year as your needs and plans change.

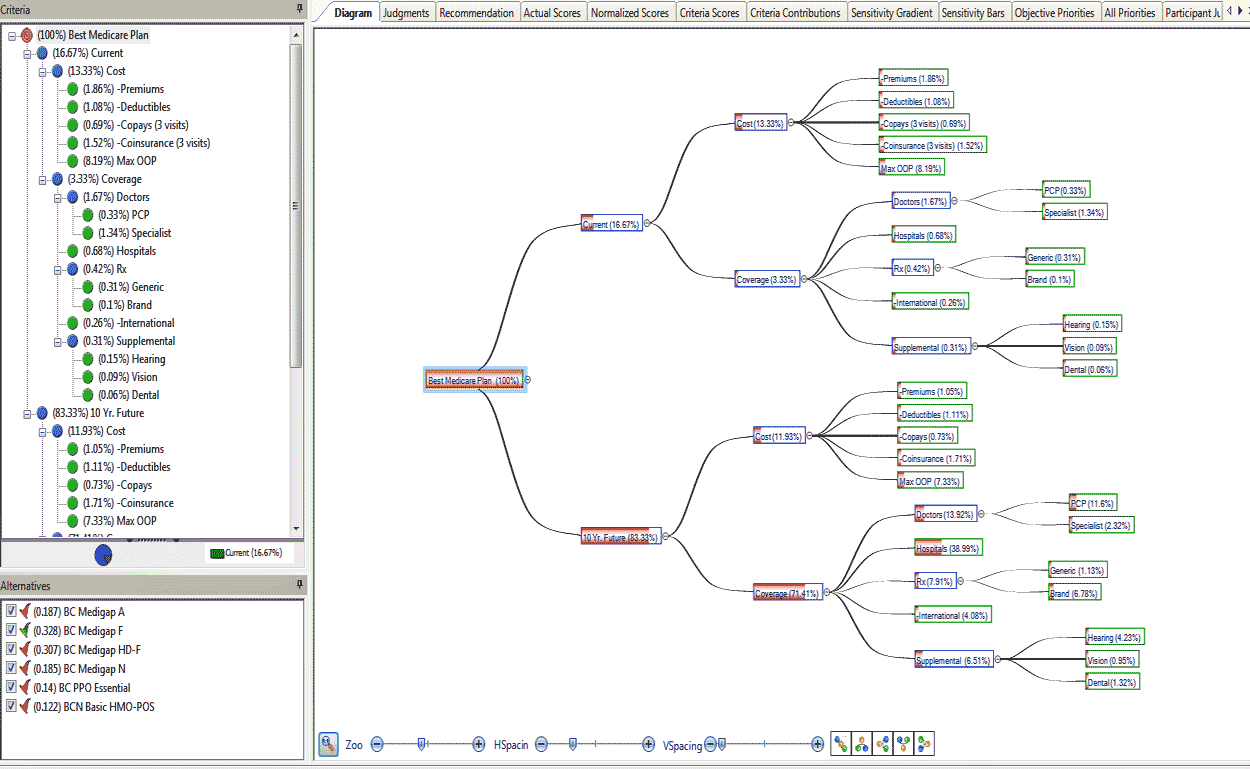

Selecting alternatives is covered in several places in the ISO standard, but the closest model we recommend is project selection using the analytic hierarchy process (AHP) found in ISO 16355-2:2017 Clause 9.1.2.8.

In our next newsletter, we share examples of these ISO 16355 tools to this Medicare Plan selection process like this one:

If you want to learn more about ISO 16355 and the modern QFD toolset, please consider attending the next QFD Green Belt® and QFD Black Belt® courses. You might be also interested in the in-house training options.

For questions, please contact the QFD Institute.